Report: Sustainable Farmland Investment Strategies

This post announces the publication of a report produced by students writing for the Conservation Finance Network news team at Yale Center for Business and the Environment.

With the rise of impact investing, there has been a jump in investment strategies promoting sustainable agriculture. This report attempts to understand the subset of farmland investors employing sustainable agriculture strategies by focusing on the following questions.

Do sustainable farmland investments deliver financial, environmental and social returns? If yes, to what extent? How are those returns realized?

Initial research indicated that there is limited literature on farmland investments that employ sustainable farmland strategies. This paper is an attempt to understand the strategies and to identify key trends, value drivers, structural challenges, and promising opportunities.

Because of limitations related to small sample size, limited data availability, and incongruent bases of comparison, we could not draw any definitive conclusions related to returns. But we are encouraged by the industry’s progress to date.

We hope that this report will serve as a starting point for those who wish to understand the sector and incorporate sustainable farmland management practices.

Methods

The research included a literature review and interviews with experts working in the field of farmland investing with a focus on real assets.

In total, 15 stakeholders were interviewed as part of this project. We interviewed representatives of 10 sustainable farmland investment firms representing over $6 billion under management. In addition, we spoke with thought leaders and other professional experts representing management companies, nonprofit organizations, and the public sector.

The investment firms were asked questions about perceived sustainable agriculture opportunities, financial and operational strategies, investment vehicles, company motivations, value drivers, performance monitoring, risk management, and industry challenges.

Key Findings

Value Drivers

The main value drivers associated with sustainable agriculture identified across companies are: price premiums, market access, lower costs, risk mitigation, and consistent yield.

Investment Theses and Strategies

There are two dominant investment theses among sustainable farmland investors. They are:

- It creates value to invest in efficiencies and improvements, particularly those related to ecosystem function, which enhances the performance of the underlying asset.

- It is financially attractive to meet the growing demand of the natural and organic industry.

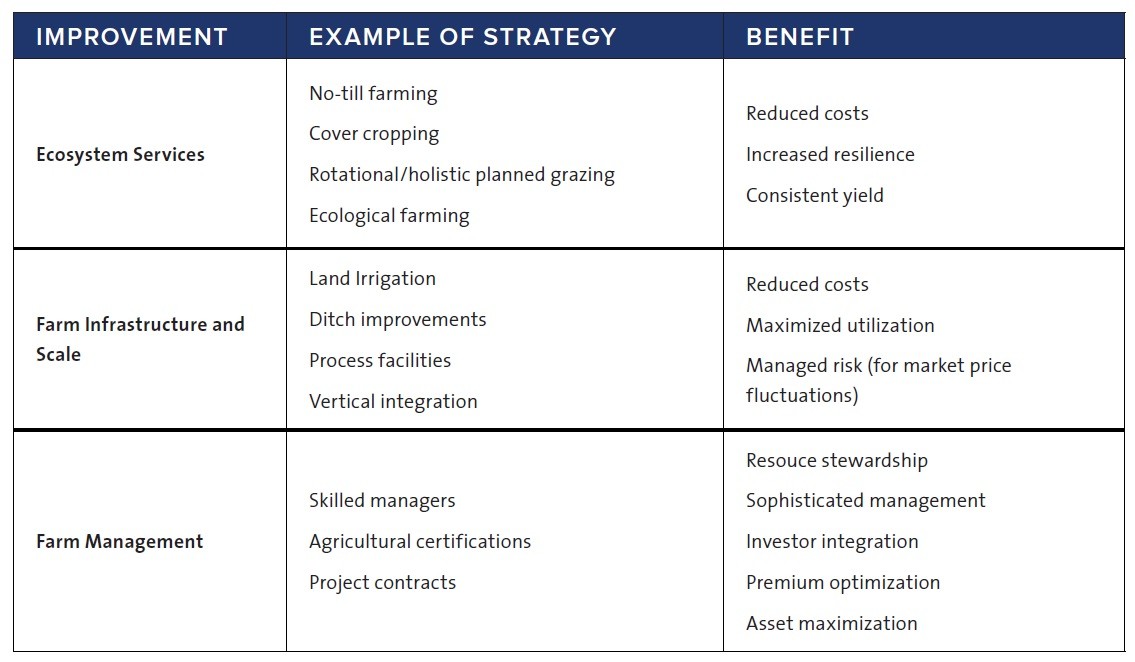

The following table provides a brief summary of the strategies and their associated benefits.

Management Models

There are two major management models: owner-operator and land-lease.

The owner-operator model is used when the firm continues to hold and manage activities on the land directly.

In the land-lease model, the owner owns the land but leases it out to be managed.

Landowners are starting to innovate lease terms to increase incentives and support sustainable agriculture strategies.

There are a number of sustainable agriculture lease innovations, including:

- Rotational lease agreements to preserve management flexibility and accommodate rotational management models

- Delayed payment schedules to accommodate transitions from conventional to organic

- Rents tied to ecological health in the form of price premiums for high-quality land and/or discounts tied to soil health stewardship to facilitate sustainable strategies

- Extended lease terms to include lease-to-own structures or options to renew indefinitely, which incentivize long-term preservation of soil health

- Use provisions that outline tenant sustainability activities and owner responsibilities to support market access and business development

Public Incentives

Public incentive programs are not a significant component of the sustainable farmland investment strategies.

Investment Performance

Based on our limited information it appears that farmland investors are targeting 9-15% IRR, which is in line with historical conventional farmland performance of 10.7%.

Although we cannot draw significant conclusions about sustainable farmland investment performance, we are encouraged by the data available to date.

This report provides additional examples through case studies focused on beyond organic production, holistic planned grazing, and resource efficiency.

Primary Challenges and Risks

Key challenges and risks identified include:

- Limitations on access to capital

- Dependence on access to sophisticated land managers

- Difficulties in performance tracking

- Overvaluation in land markets

- Lack of supportive regulation

Conclusion and Next Steps

Based on our research, it appears that sustainable farmland investment managers are generally able to deliver financial, environmental and social returns. However, we are unable to define to what extent those returns are delivered as a result of specific sustainable agriculture activities.

To date, successful farmland investors have exceptionally knowledgeable teams, willingness to experiment, and commitment to long-term value creation. They are partnered with investors that share an interest in creating sustainable food systems.

Our research suggests that the best investments are in row and specialty crop organic conversion strategies. Additionally, the prospect of the organic price premiums combined with the decreased input costs and increased yield from rotational livestock management are highly encouraging. The current investor climate requires investors to be creative on how they deliver returns. It also requires financial partners to be flexible.

As the sector progresses, we recommend the following next steps.

- Invest in data collection and monitoring to make the connection between sustainable activities and asset performance. Consider partnering with academic institutions interested in this type of work.

- Conduct a comparative analysis to understand how sustainable farmland investment strategies compare to conventional farmland investment strategies. It will be valuable to understand what factors exert the most influence and how certain activities affect performance and risk mitigation.

- Assess viability of additional social and environmental revenue streams. Emerging environmental markets, such as the carbon market, and public incentive programs that compensate for the public benefits associated with sustainable agriculture practices, like federal funding and pay-for-success bonds, may be viable sources of revenue for these strategies.

To read more, download the report from the Conservation Finance Network website.

To comment on this article, please post in our LinkedIn group. You may also email the authors of any of the Conservation Finance Network's articles via our contact form or contact us via Twitter.