Pay-for-Success Financing

In Brief

Pay-for-Success financing provides an alternate approach to conservation funding by aligning payment for project costs with the delivery of outcomes, rather than actions.

This model presents a promising opportunity for certain conservation projects by de-risking private investment and generating new avenues for funding.

The Baileys Trail System for mountain biking at Wayne National Forest demonstrates the potential for PFS to create long-term conservation and economic benefits.

Shea Flanagan and Nathalie Woolworth

This explainer is available in PDF format for non-commercial Creative Commons uses if it is shared with attribution and without remixing. We welcome your feedback. We encourage you to contact us if you decide to share it with a group.

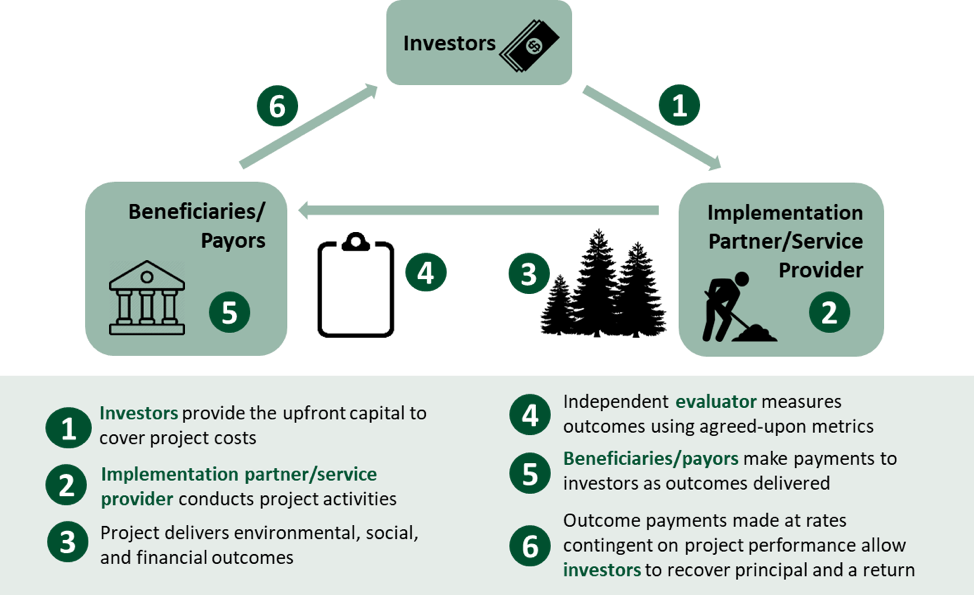

Traditionally, conservation efforts raise funding for projects and actions in the hope that those activities will result in desired outcomes. Pay-for-success (PFS) financing offers an alternative approach. This model ties funding for conservation to project outcomes, incentivizing the achievement of objectives and shifting risk away from public agencies and conservation organizations that implement on-the-ground work.

PFS models use contracts to align the delivery of project outcomes with payments. These contracts secure capital from private investors for initial project costs. In return, they require commitment from project beneficiaries, or the stakeholders willing to pay for project outcomes based on the benefit they receive (also called “payors”). Beneficiaries pledge to pay for pre-agreed project outcomes as or after they are delivered. This setup means that upfront investors are repaid based on the quantity or certainty of project outcomes achieved, thus incentivizing investors to support projects that generate desired results. This financing model goes by many names, including pay for performance, social impact bond, social benefit bond, environmental impact bond, and value-based purchasing.

PFS financing enables projects to move forward in instances where funds are otherwise unavailable, or where beneficiaries deem project impacts too uncertain to provide funding at the outset. Because a beneficiary only pays when outcomes are achieved, investors bear the risk of project underperformance, not the beneficiary. By enabling private sector investment in conservation, this model can unlock opportunities for funding beyond conventional public and philanthropic sources, thereby increasing the overall scale of funds available to address conservation challenges.

How Does PFS Financing Work?

At the most basic level, PFS models follow the steps below.

- Private investors fund the initial costs of a project.

- Implementation partners, also known as service providers, use this investment capital to undertake on-the-ground work.

- An independent evaluator (e.g. a university, research entity or neutral third party) assesses the project’s performance relative to standards agreed upon by all stakeholders in contracts.

- Beneficiaries or payors repay investors at pre-agreed rates dependent on the project outcomes delivered.

With PFS, a project that achieves or exceeds its established performance standards delivers investors a higher return on their investment. In most cases successful projects also deliver a higher level of economic benefit to payors, increasing their ability to compensate investors. If outcomes do not meet predetermined standards, investors receive a lower rate of return or may even have to compensate payors to assist in recouping costs.

A project developer with experience developing PFS transactions is often brought in to gauge PFS feasibility, structure the deal, and identify and coordinate stakeholders.

How Does PFS Financing Differ from Traditional Project Funding?

Traditional funding for conservation, most of which comes from public and philanthropic sources, supports the implementation of actions intended to provide environmental benefits without the expectation of a return on investment. By setting up transactions that have the potential to generate a financial return, PFS financing accesses a new sector of capital for conservation. Engaging private investors to cover upfront project costs can also accelerate the pace and scale of work by removing constraints associated with annual funding cycles and allowing payors more time to secure funding for repayments.

Traditional funding sources also do not incentivize effectiveness and cost efficiency since they support activities instead of outcomes. As such, public agencies and donors end up bearing the risk if results are not delivered. By tying payments to outcomes, PFS financing can increase the likelihood that desired outcomes will be achieved, help stakeholders clearly document return on investment, and inform future decision-making about how to use funds more efficiently and effectively. This model also shifts risk to the private sector since investors are ultimately compensated based on outcome delivery.

Further, PFS financing promotes innovation by providing funding for projects that might otherwise be deemed too risky or unproven to attract funds upfront. The promise of immediate funds also increases certainty that the project will move forward with a specified scale and timeline in mind. This added clarity encourages stakeholders to collaborate on initiatives that they may otherwise pursue independently at a smaller scale or not at all.

What Conditions Need to Be in Place for a Successful PFS Project?

Before undertaking a PFS project, it is important to consider the conditions under which these projects are most likely to succeed. As one entity seeking to expand its range of financing opportunities, the U.S. Forest Service’s (USFS) National Partnership Office

The practice of raising and managing capital to support land, water, and natural resource conservation.

Team has developed some considerations on what conditions lead to successful PFS implementation. Their thinking has evolved through work with partners such as the Network, the National Forest Foundation and outcomes-based capital firm Quantified Ventures.First, given the complexity and cost associated with PFS transactions, it is best to explore other more traditional funding routes before turning to PFS. For instance, USFS tries to focus use of PFS financing on projects with implementation costs totaling more than $3 million. At this scale, other sources of funding are less likely to be available for USFS projects and transaction costs are more manageable.

PFS projects must address a known need by funding activities with identifiable and measurable outcomes that are attributable to project activities. USFS sees PFS as uniquely suited to fund activities that are either proven to deliver outcomes that a PFS approach could help to scale up, or predicted to deliver outcomes that a PFS approach would help to test.

USFS also notes that the business case for both payors and investors must be clear and compelling, and that payors must be willing and able to repay investors. In addition, service providers must have the capacity and expertise to undertake the project, and project implementation and investor repayment must be completed within a reasonable term.

According to Seth Brown, director at Quantified Ventures, it is important to consider the project’s impacts, which stakeholders would benefit from those impacts, whether the benefits outweigh the costs, and — perhaps most importantly — whether there is a willingness to pay for the ecosystem services delivered by the project.

Who Is This Tool Right For?

A range of entities in a variety of conservation contexts could find PFS financing useful. Any organization looking to scale up its impact or test new ideas, but lacking the upfront funds to do so or the time to raise sufficient funds, could benefit from PFS. Entities that seek to change the conversation around ecosystem services can use PFS as a model to articulate their economic benefits and reframe these services as assets worth investment.

PFS approaches were first employed in other sectors like healthcare and social services, but are increasingly being piloted in the environmental sector. PFS financing has been used to fund stormwater management, construction of coastal buffers, reduction of nonpoint source agricultural pollution and removal of urban trees.

PFS Case Study: Recreation Infrastructure at the Wayne National Forest

USFS and the National Forest Foundation are partnering with Quantified Ventures to pilot PFS financing on National Forest System lands. PFS provides a way for USFS to help direct capital to support faster implementation of agency priorities. By splitting the cost of projects with stakeholders that share in the benefits, USFS and the communities it serves can achieve impact more quickly.

USFS’s first PFS project, currently in development, seeks to improve sustainable recreation infrastructure for Wayne National Forest and adjacent lands in Athens County, Ohio — one of the state’s most economically distressed counties. A PFS transaction will fund much of the initial cost associated with construction of an extensive mountain biking trail network called the Baileys Trail System.

Once finished, the Baileys Trail will be the longest connected, purpose-built mountain biking trail system east of the Mississippi River. According to USFS, the project will also improve facilities in community parks adjacent to the forest that will serve as trailheads for public access.

In total the project will raise an estimated $5.4 million to fund the upfront cost of building an 88-mile mountain biking trail system across 9,000 acres of national forest and adjacent landscapes. $2.4 million will come from the PFS transaction (an outdoor recreation environmental impact bond) and the remaining $3 million will come from federal New Markets Tax Credits that incentivize investment in low-income communities.

A feasibility analysis conducted by Quantified Ventures found that construction of this system will significantly boost visitation to the forest and surrounding communities. Increased visitation is projected to in turn yield economic and quality of life benefits for Athens County.

The city and county of Athens will serve as the payors, and will repay investors at rates of return dependent upon successful achievement of pre-determined measured outcomes, including increased number of mountain bikers, non-local visitors and registered businesses. A group of city and county governments called the Council of Governments was formed to contract out project implementation to service providers that will be paid by the investor capital to construct the trail.

Ohio University will serve as the evaluator to assess achievement of project outcomes. According to Quantified Ventures, using a third-party evaluator allows for greater transparency regarding the data, government spending, and national forest and recreational infrastructure usage.

The project is structured so that payors will initially make below-market interest payments, which will ramp up if the performance of the project is proven. At that point, payments will be adjusted.

“There’s downside protection at the beginning, and then you’re only going up, rather than needing a clawback,” said Brown. A clawback is a contractual obligation for investors to return funds already disbursed. Brown expects the transaction to be finalized in October 2019, after which trail construction can begin.

Using PFS financing for this transaction increases the upfront availability of funds to build the trails, boosts the flexibility with which funds can be deployed, shares the project cost between multiple stakeholders invested in the region’s future, and significantly decreases the time needed to build the trails. The monitoring that is part of the PFS model will also provide robust data on economic outcomes from a recreation infrastructure project, which can inform future PFS approaches and USFS decision-making.

Perhaps most importantly, this project brings together stakeholders that may not normally connect (e.g. a federal agency, local governments, a research university, and outdoor access and recreation proponents) — around the common goal of rural economic prosperity.

“You’re changing the conversation by way of financing it differently, which I think is pretty invaluable,” Brown said. “You’re connecting people with different viewpoints and concerns because you’re treating the project as an actual asset that has a greater effect than just providing access to the outdoors.”

Where Can I Find More Information?

Other PFS toolkits:

- Environmental Incentives' PFS toolkit

- Winrock International’s Conservation PFS how-to guide (for agricultural pollution)

Other case studies:

- Conservation Finance Network's analysis of the first U.S. environmental impact bond

- Conservation Finance Network’s analysis of DC Water’s environmental impact bond

- Nature’s Returns webinar on Blue Forest Conservation’s forest resilience bond

- Blue Water Conservation District and The Nature Conservancy’s PFS example

- Environmental Incentives’ PFS example with Nevada Conservation Credit System

Note: Our expert coauthors volunteer their time to assist our writers with these pieces.

To comment on this article, please post in our LinkedIn group, contact us on Twitter, or email the author via our contact form.